What’s caught our eye recently in the legal press

By Oliver White, Underwriter

Estimated Reading Time – 5 minutes 24 seconds

NHS Trusts faces over £4m in payouts for infection claims

https://claimsmag.co.uk/2024/12/nhs-trusts-faces-over-4m-in-payouts-for-infection-claims/

This article from Claims Media discusses the results of an Investigation made by Medical Negligence Assist. This found that NHS Trusts have paid over £4.2 million in damages for healthcare-associated infection claims since 2021. In this time period, 85 claims were lodged against 76 NHS Trusts, of which 66 were successful. Approximately 300,000 people are affected by HCAIs annually, which have significant financial and human impact.

Emergency caesarean sections, birth injuries and the urgent need to improve UK maternity care

https://www.bindmans.com/news-insights/blogs/emergency-caesarean-sections-birth-injuries-and-the-urgent-need-to-improve-uk-maternity-care/

An interesting article from Bindmans discusses a report published by the Care Quality Commission in November 2024. This report suggests that there are “entrenched” problems with communication and postnatal care, which requires improvement. It emphasises the disparity in how different groups experience maternity care, with those who had an emergency caesarean birth being one example, having a poorer than average experience across nearly all the questions asked.

Emergency caesarean births increased by 2 percentage points from 21% in 2023 to 23% in 2024. This is disappointing considering the risks that such births involve. Postnatal care is also found to be lacking. Over the last five years women have reported difficulties in getting a member of staff to help them when needed, being given information or explanations when needed, and being treated with kindness or and compassion.

Birth injury cases and the resultant litigation have cost the NHS £4.1 billion over the last 11 years – nearly £373 million a year. This emphasises the need for care in this area to be improved. Recommendations and funding have been put in place by the government recently, but the report shows that more needs to be done.

Medico-legal market consolidating and growing “more strongly”

Medico-legal market consolidating and growing “more strongly”

An article on a slightly different topic here, discussing trends the medico-legal market over 2024. The value of the market grew by 4% over 2024, double the growth rate of the previous year, according to estimates. The sector is also showing signs of consolidation, having traditionally been populated by many smaller companies, larger groups are increasing their share, often by acquisition. There has been an increase in PI and medical negligence claims registered in the 2023/24 year which should further drive demand upwards.

Mind the (justice) gap: Why are RTAs going up but claims still down?

https://www.legalfutures.co.uk/blog/mind-the-justice-gap-why-are-rtas-going-up-but-claims-still-down

This article from Legal Futures discusses the increasing gap between the number of RTA injuries and the number of motor injury claims. Between 2020 and 2023, RTA injuries increased by 15% but claims fell by 29%. The article argues that the most likely reason that injured parties who could claim end up not claiming is because either they don’t know that they can, or they don’t believe it will be worth their while. This shows a worrying trend in access to justice, and the author hopes that the government will soon address these issues.

Whiplash boost fails to impress

https://www.newlawjournal.co.uk/content/whiplashboost- fails-to-impress

This article from New Law Journal explores how the 15% increase in the tariff for soft tissue injuries is too low. APIL’s response to the increase is that the increase is not enough. They state that if the tariff increased in line with inflation based on the CPI the increase would be 22%, however it was based on predictions about future inflation. Kim Harrison, APIL president stated that ‘The facts are that since the tariff came into effect, the number of claims has plummeted, the cost of injury claims to insurers has nosedived, and yet motor premiums have continued to rise’.

Delays to clinical negligence claim settlements reached a record high last year, new data obtained by APIL shows. This article was originally published in Insight, a quarterly research update for APIL members. To explore APIL membership options visit apil.org.uk/join-apil

The figures provided by NHS Resolution (NHSR shows that the average time between claim notification and settlement now stands at over two years. As a result, a typical clinical negligence claimant has to wait almost nine months longer for their claim to settle when compared to ten years ago. This is an increase of 51%.

Delays have affected claims of all values. For example, claims valued at £1,501 – £25,000 are now taking on average, almost six months longer to settle when compared to ten years ago. Claims valued at £1million – £2 million are taking over twelve months longer to settle.

These huge delays are likely to have driven increases to claimant legal costs. Indeed, NHSR themselves acknowledge that ‘the longer cases run for, the higher the costs’.

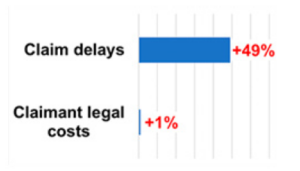

Delays have, however, far outstripped increases in costs. In clinical negligence claims valued at £1,501 – £25,000, for example, claim delays have increased by 49% over the past ten years. During the same period, average claimant legal costs for these claims were up by just 1% once inflation is taken into account.

Until NHSR finally begins to control delays, costs will remain unnecessarily high levels and victims will have to wait longer to receive justice and support.

Temple Comment

By Matthew Best, Director – ATE Partnerships, Head of Personal Injury & Clinical Negligence

‘The data obtained by APIL certainly makes an interesting read. It is particularly interesting to see that such a rise in claim delays has only increased claimant legal costs by one percentage point; and that looks to be down, in part, to inflation.

How much more evidence do we need to produce to show that claimant legal costs are not the sole burden to the NHS budgets? The evidence here is stark. I am not for one minute trying to imply that legal costs are not high. They are higher than they should be, but let’s not forget, those defending legal actions get paid regardless of the outcome, this surely has to be considered?

Taking those legal actions that would be affected by fixed recoverable costs, should they be introduced, they are being delayed by, on average, an extra six months.

If a claimant lawyer is capped on the fees they earn in these cases, then surely the costs applicable need to incorporate the delays we are all seeing?

The increased delays also likely mean that claimant law firms are having to shoulder outlays for longer. That would almost certainly give rise to potential cash flow issues, in turn access to justice gets delayed.’

Of ‘no interest’ at all

Temple can help with this situation; we have disbursement funding options operating at a 0% interest rate. The process is very simple and funds can be paid pretty instantly, meaning experts can get paid quicker and as the claimant lawyer, you know you have progressed your client’s case in a timely and efficient way. If you want to know more about our disbursement funding options, please call us on 01483 577877 or drop me an email to

Oliver White

Underwriter

Oliver White

Oliver is an Underwriter who joined Temple in 2022 as an Underwriting Support Assistant. He became a Trainee Underwriter in September 2023 and completed his training in August 2024. Oliver holds an LLB in Law from the University of Exeter, having graduated in 2020. His legal background equips him with a strong understanding of the legal issues relevant to cases referred to Temple, enabling him to make efficient and accurate underwriting decisions.

Oliver works across both the Clinical Negligence & Personal Injury and Commercial teams, reviewing referred cases and determining coverage. He also manages delegated authority schemes, acting as the primary point of contact for these firms and ensuring that Temple continues to meet their ATE insurance needs.

In 2024, Oliver took leadership of the Northern Ireland project, taking on full responsibility for its management and direction.

Read articles by Oliver White